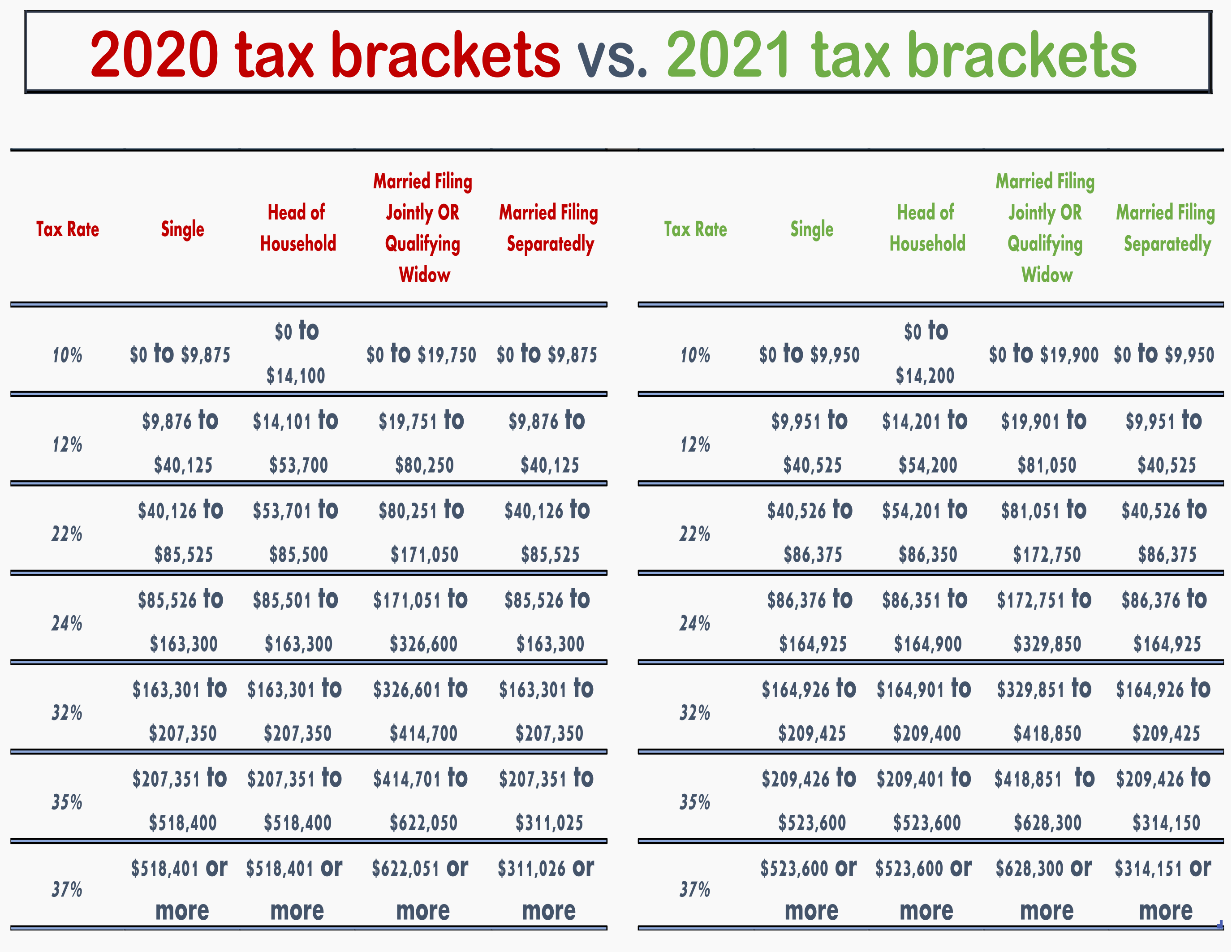

"We know that smoking causes blood vessels to constrict and we know that it causes babies to not grow as well and that occurs most likely because it affects placental blood flow," Manning said. The report also looked at fetal mortality rates by state and found, between 20, rates were highest in Mississippi at 6.38 per 1,000 and other states in the South and lowest in New Mexico and Connecticut at 2.60 per 1,000 and states in the West and Northeast.Īdditionally, the fetal mortality rate for women who smoked during pregnancy was 9.62 per 1,000, almost double the rate for women who did not smoke during pregnancy at 5.08 per 1,000. "You shouldn't think that there's something genetic or inherent about Black pregnant people that causes them to have worse outcomes," Manning said. "So, it's good to see that there is a small decrement in deaths for that group, but there's still a fair way to go." "Their rates are still almost double the average rate for all women," he said. 2022 Federal Tax Brackets With Each Brackets Marginal Tax Rate, Based On A Taxpayers Taxable Income. 2021 tax year (1 March 2020 28 February 2021) 321 601 445 100, 67 144 + 31 of taxable income above 321 600 445 101 584 200, 105 429 + 36 of taxable. However, Manning said it's notable that the rate of 9.89 per 1,000 is nearly double the national rate of 5.74 per 1,000.

Married Filing Separately is the filing type used by taxpayers who are legally married, but decide not to file jointly using the Married Filing Jointly filing type. No significant changes in fetal mortality rates were seen for other groups including American Indian or Alaska Native, Asian, Hispanic, Native Hawaiian/Pacific Islander and white women. What is the Married Filing Separately Income Tax Filing Type. Income Tax Rate (Year 2023 onwards) P250,000 and below. The report also found Black women were the only racial/ethnic group to see a significant change for mortality rates, declining 4% from 10.34 to 9.89. The new income tax rates from year 2023 onwards, as per the TRAIN law, are as follows. Tax Year 2021 Tax Rates by Income and Filing Status. 1 But the 2022 tax brackets have been adjusted for inflation, so be aware of what income bracket you (or you and your spouse) fall within. The 2022 federal income tax rates are the same for income earners as they were in 2021ranging from 10 to 37.

The inflation adjustment automatically lifted it from 9,875 to 9,950 for single filers. Federal Income Tax Rates and Brackets for 2022. Compare the 10 tax bracket for 2020 to what it would be just one year later in 2021. Simon Manning, director of fetal care at Brigham and Women's Hospital in Massachusetts, told ABC News. for 2020 only,the portion of any federal net operating loss deduction. The 50,000 in the taxable earnings example would have put you in the 22 tax bracket as a single filer in tax year 2021. "Although they note that the number of fetal deaths increased, what's actually important is that the overall rate was unchanged, because the number of fetal deaths obviously depends on the number of pregnancies, which presumably increased if the rate was unchanged," Dr.

0 kommentar(er)

0 kommentar(er)